Business Records Fraud: What It Is and How to Fight It

If a company’s paperwork doesn’t match reality, you’re looking at business records fraud. That can mean fake invoices, altered contracts or hidden liabilities. The goal is simple – make the books look better than they are so someone can steal money or boost a stock price.

Common ways fraudsters mess with records

First, they create phantom vendors and send payments to accounts they control. Second, they inflate revenue by recording sales that never happened. Third, they hide expenses by classifying them under vague headings. All three tricks rely on a weak audit trail or people turning a blind eye.

Often the fraud starts small – a junior accountant might “help” a manager with a quick entry to meet a deadline. Over time those shortcuts add up and become a big problem. The warning signs are easy to miss if you’re not looking for them, but they show up as unusual patterns in the data.

Red flags that tell you something’s off

Look for duplicate invoices from the same supplier, especially if the amounts are identical. Sudden spikes in revenue at month‑end without a clear business reason raise questions. When expense accounts have many “miscellaneous” entries, it could hide wrongdoing.

Another clue is when key people avoid answering basic questions about transactions. If you ask for supporting documents and get vague answers or delays, that’s a signal to dig deeper. Auditors also notice when the same person signs off on multiple steps of a transaction – segregation of duties matters.

Technology can help catch these problems fast. Data‑analysis tools scan thousands of rows for patterns that humans miss. Simple scripts can flag duplicate vendor names, out‑of‑range amounts or missing approvals. Using software doesn’t replace a good auditor, but it gives you an early warning system.

When fraud is discovered, act quickly. Freeze the accounts involved and preserve all records before anyone can delete them. Bring in an independent forensic accountant to trace where money went. Reporting to regulators may be required, depending on the size of the loss.

Prevention starts with strong policies. Require two‑person approvals for any payment over a set limit, rotate staff duties regularly and keep a clear audit trail. Training employees to recognize phishing emails or fake invoices reduces the chance someone gets tricked into helping fraudsters.

Finally, foster a culture where people feel safe raising concerns. An anonymous hotline or regular ethics meetings can give staff an outlet to report suspicious activity without fear of retaliation. When everyone knows that tampering with records is taken seriously, it’s harder for fraudsters to succeed.

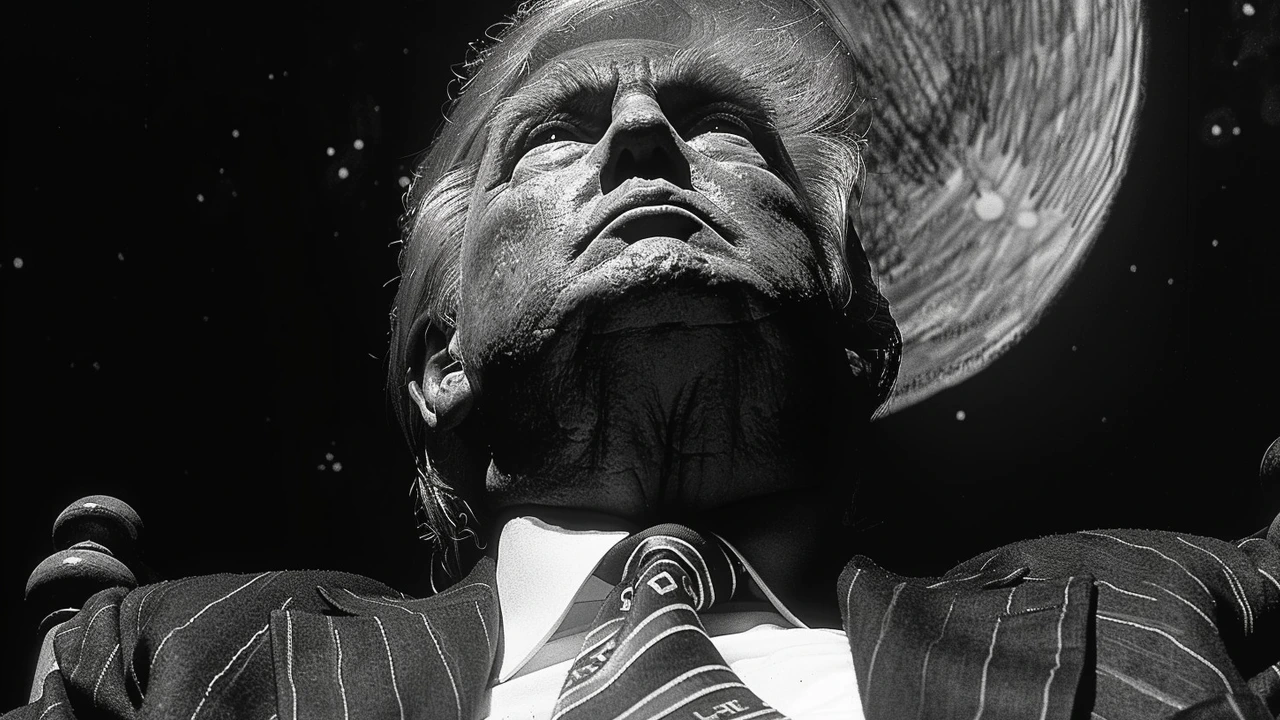

Donald Trump Convicted on All 34 Allegations of Business Records Fraud in Manhattan Court

May 31, 2024 / 10 Comments

Donald Trump has been found guilty on all 34 counts of business record falsification in a Manhattan trial. Evidence indicated that Trump orchestrated a scheme to disguise payments as legal expenses to cover up an alleged affair. Despite Trump's plea of not guilty and claims of innocence, the jury delivered a unanimous verdict. Sentencing is to be scheduled soon.

READ MORERECENT POSTS

- DNC Boosts State Parties as Harris Raises $200 Million: Strategic Investments to Strengthen Democratic Stronghold

- Chelsea clinches inaugural expanded FIFA Club World Cup 2025 with 3-0 win over PSG

- Jack Doohan's Journey to Formula 1: From Chennai to the Pinnacle of Motorsport

- Boston Celtics' Kristaps Porzingis Optimistic Despite Injury Ahead of Game 3 in NBA Finals

- FC Barcelona vs Manchester City: Preseason Friendly Clash in Orlando Set to Thrill Fans